Business Lighting Rebate

Our goal for the Business Lighting Rebate is to promote energy efficiency through the use of new, high efficiency lighting. Lighting is a critical component of every business.

Our goal for the Business Lighting Rebate is to promote energy efficiency through the use of new, high efficiency lighting. Lighting is a critical component of every business.

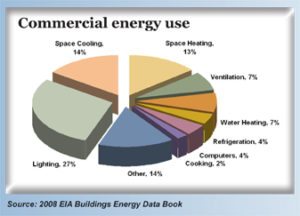

You may be surprised to learn that lighting can take a larger share of a building’s electricity use than any other single end use. Lighting systems produce sizable amounts of heat as well, and are typically the largest source of waste heat inside commercial buildings. Energy-efficient lighting, such as compact fluorescent bulbs, create less heat than inefficient lighting. By decreasing internal heat gain efficient lighting also reduces a buildings cooling requirements.

Significant cost savings can be achieved with energy-efficient improvements. Due to continually improving technology, lighting usually provides the highest return on investment of major upgrades. With good design, lighting energy use in most buildings can be reduced up to 50 percent while maintaining or improving lighting quality. Such designs typically pay for themselves in energy savings alone within a few years, and offer more benefits in terms of the potential savings for smaller and less costly cooling systems.

ENERGY STAR®; www.energystar.gov

This rebate is being offered to commercial, industrial and agricultural cooperative business members. Only members with greater than 10 fixtures at their facility will qualify. The rebate amount will be determined prior to installation and calculated based on an audit of existing and replacement lighting. Total based on an audit of existing and replacement lighting. Total rebate amount is limited to $30,000 per member per year and in no case will exceed 40 percent of the total equipment cost.

This rebate is being offered to commercial, industrial and agricultural cooperative business members. Only members with greater than 10 fixtures at their facility will qualify. The rebate amount will be determined prior to installation and calculated based on an audit of existing and replacement lighting. Total based on an audit of existing and replacement lighting. Total rebate amount is limited to $30,000 per member per year and in no case will exceed 40 percent of the total equipment cost.

The focus of the program is to save the member money by using less energy to light their facility. When assessing the opportunities for improvement presented by an existing lighting system, the first step is to measure how effectively the existing light levels and characteristics serve their function.

Many opportunities exist for cost effective retrofits to an existing lighting system and it is possible to simultaneously incresase lighting levels and use less energy if the most efficient technology and practices are used.

The first step on the road to implementing new energy-efficient lighting your facility is to contact Osage Valley at 660-679-3131 Ext 5547. We can help you determine your eligibility and provide the application, lighting tables and all other needed information to begin your lighting retrofit project.

The first step on the road to implementing new energy-efficient lighting your facility is to contact Osage Valley at 660-679-3131 Ext 5547. We can help you determine your eligibility and provide the application, lighting tables and all other needed information to begin your lighting retrofit project.

You will want to be sure you have a trusted lighting vendor to help you with new lighting recommendations and a knowledgeable employee from the facility to assist with your initial walk-through lighting audit.

www.energystar.gov Click on Buildings & Plants tab for extensive information about energy-efficient buildings.

http://energy.gov/public-services/commercial-buildings This site provided by the U.S. Department of Energy (DOE) will show you how to use energy in your workplace more efficiently.

www.lightingtaxdeduction.com/tax_deduction.html Guide & FAQs to the Energy Efficient Commercial Buildings Lighting Tax Deduction information.